Risk management

Basic policy

The Yaskawa Group has established the following basic policies for risk management in its “Basic Rules for Crisis Management”.

- Establish a crisis management system in Yaskawa Group to raise awareness and prevent crisis.

- Clarify the procedures to be followed in the event of a crisis, and minimize the impact on management and business operations by responding promptly and appropriately in the event of a crisis.

Promotion system

Yaskawa monitors risks related to the status of management, including economic and market conditions, at executive meetings such as the Executive Committee and the Board of Directors. In addition, we have established the Basic Rules for Crisis Management for the purpose of promptly and accurately addressing risks that may directly or indirectly interfere with the management or business operations of the Group. In accordance with these rules, we have established the Crisis Management Committee, which is managed by the Chairperson of the Crisis Management Committee appointed by the President, and its subcommittees.

Risk management initiatives

On a semi-annual basis, the Risk Management Committee, whose members include top management, including the chairs of various technical committees, meets to plan and promote risk management education, evaluate risks, and take appropriate measures, such as setting up a countermeasure headquarters according to the level of risk in the event of an occurrence. In addition, the status of risk management is regularly reported to the Executive Committee, the Board of Directors, and the Sustainability Committee to supervise and monitor the risk management of the entire company and to strengthen risk management.

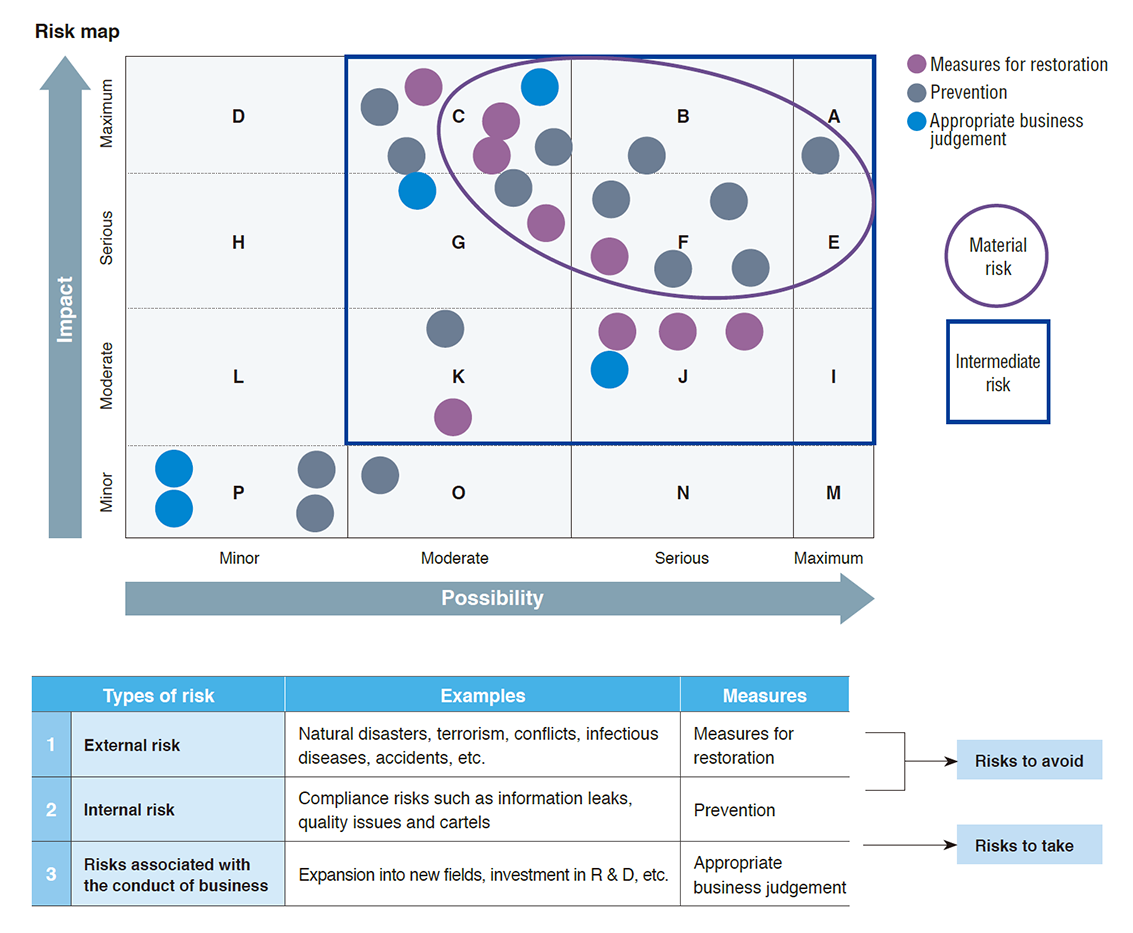

Definition and classification of risks

The Yaskawa Group classifies risks into three categories: (1) risks such as natural disasters that are beyond human control, (2) risks that have internal causes, such as compliance issues, and (3) risks that should be taken as management decisions, such as investments in new businesses. The Yaskawa Group then identifies risk items, classifies them in terms of their impact and possibility, and implements appropriate measures for each item.

Region

Region

Principles & vision

Principles & vision

Procurement

Procurement

Sustainability for the Yaskawa Group

Sustainability for the Yaskawa Group

Customer satisfaction

Customer satisfaction

Supply chain

Supply chain

Social contribution

Social contribution

Compliance & risk management

Compliance & risk management