Disclosure policy

1. Basic Policies for the Disclosure of Information

Yaskawa clearly states in our “Yaskawa Group Corporate Code of Conduct” that we are to “protect not only its own information but also important information of other companies and personal information” as well as “discourage and tolerate no insider trading,” and that we are to “comply with company information disclosure rules and strive to disclose correct information in a timely manner.”

Based on this Code of Conduct, we disclose information in compliance with the various laws and regulations including the Financial Instruments and Exchange Act and rules on timely disclosure established by the stock market where our stocks are listed. We are also proactive in disclosing, upon considering fairness and timeliness, information that does not fall under the above conditions which is believed to have practical impact on investment decisions and other such matters and information believed to be useful in deepening the understanding of our company among investors.

The Definition of Disclosed Information

- ・Statutory disclosures

Disclosures in accordance with the Financial Instruments and Exchange Act

(Securities Reports, Semi-annual Securities Reports, Extraordinary Reports, etc.)

- ・Disclosures in accordance with the Companies Act

(Business Reports, Financial Statements, Consolidated Financial Statements, etc.)

- ・Disclosures required by the Tokyo Stock Exchange

Materials about quarterly financial results and related supplementary data

Corporate Governance Reports

Disclosures of information about corporate decisions or events for which the Tokyo Stock Exchange requires timely disclosure

- ・Other disclosures

Disclosure materials related to IR activities (Annual Report, etc.)

Everyday communications with analysts and institutional investors (Business briefings, Quarterly results briefings, etc.)

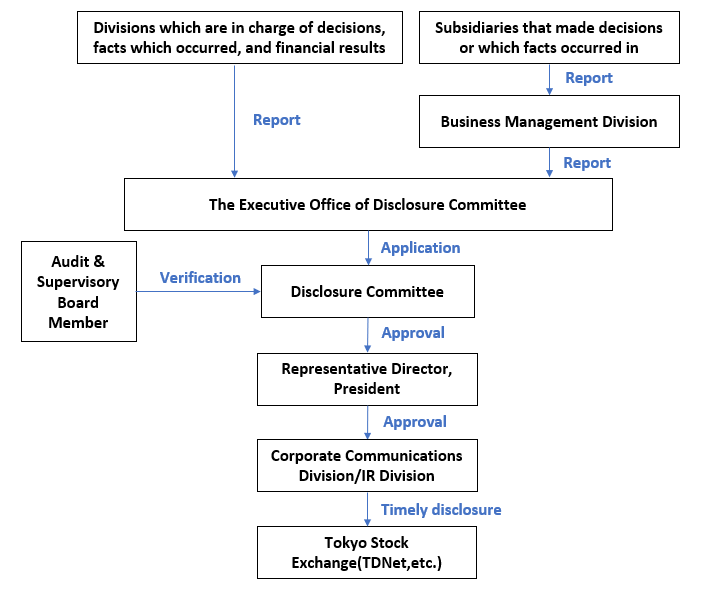

2. Corporate Structure with Regard to the Disclosure of Information

Based on the “Securities Listing Regulations” as prescribed by the Tokyo Stock Exchange, we proceed with the timely disclosure of information upon considering our internal regulations and obtaining approval from those authorized for approval. Efforts are also made so that each department responsible gains a timely and accurate understanding of information with regard to company duties (such as facts which have been decided and facts on incidents that occur) as well as information with regard to financial results, including those of our subsidiaries, and that a structure is developed to enable us to disclose information to our investors and to financial instruments bourses in a timely and appropriate manner. Furthermore, as a step to prevent wrongdoings including those related to the disclosure of information, we also promote compliance throughout our company through our compliance committee and have in place an internal reporting system called “Compliance Hotline.”

3. Method for the Disclosure of Information

As to the disclosure of information that applies to the regulations at each bourse where we are listed, our company complies with the regulations in making disclosures on TDnet, supplied by the Tokyo Stock Exchange, as well as post the information on our company website so that the information may be communicated in a broad manner. As to information that may not be applicable to the disclosure rules, we also make efforts to communicate, through our corporate website and other such means in a proactive and fair manner, information which we determine would aid our stakeholders in understanding our company.

However, not all information is necessarily disclosed on our company website, and the expressions through which the information is disclosed via other methods may vary.

Internal System for Timely Disclosure to Tokyo Stock Exchange

4. Control over Internal Information (Prevention of Insider Transactions)

For the purpose of establishing operational guidelines for the control standards and other regulations on the disclosure of important facts and the handling of internal information, our company has regulations concerning responsibilities for timely disclosure and preventing insider transactions. We are also thorough in controlling insider information and provide training for our directors and employees.

5. Quiet Period

In order to prevent leaks of information on financial results (including each quarter result) to maintain fairness, our company, in principle, embraces a quiet period for four weeks prior to the announcement of financial results of each fiscal quarter. This is the period during which we refrain from organizing investor meetings and answering questions or offering comments with regard to our results or performance outlook.

However, even during the quiet period, in the event that we find that a variance is incurred from our performance forecast that warrants disclosure, we will disclose as appropriate the information in accordance with the regulations as determined by the stock exchange where our stocks are listed.

6. Outlooks

Forecasts, outlooks concerning our future performance are based on information that is available as of the pertinent period and certain prerequisites seen as reasonable and actual performance may vary depending on various factors.

Important factors that may impact our actual performance and other such matters include global economic conditions, trends in demand for our products and services, and movements in the currency and stock markets, and are not limited to such factors.

When using information indicated on our corporate website, please also refer to the disclaimer that is also available on our website.

Region

Region

Principles & vision

Principles & vision

Procurement

Procurement

Sustainability for the Yaskawa Group

Sustainability for the Yaskawa Group

Customer satisfaction

Customer satisfaction

Supply chain

Supply chain

Social contribution

Social contribution

Compliance & risk management

Compliance & risk management