Region

Region

- Products & solutionProducts & solution

- The solution concept i3-Mechatronics

- Servo motors

- AC Drives

- Industrial robots

- System engineering

- Energy saving & creation

- Customer Case Studies

- ServiceService

- CompanyCompany

- About us

- Message from Masahiro Ogawa

- Corporate data

- Our business

- Directors & executive officers

- Global network

- Network in Japan

- History

- Milestones

- Corporate brochure

- Corporate movie

- News & media

- Principles & vision

- Procurement

- Careers

- TechnologyTechnology

- CTO message

- Core technologies

- YASKAWA Technical Review

- Yaskawa technical history

- Intellectual property

- International standards

- Investor relationsInvestor relations

- IR materials

- Management system

- Message from Masahiro Ogawa

- Vision 2025

- Realize 25

- Yaskawa Principles

- Corporate governance

- Dialogue with shareholders & investors

- Disclosure policy

- Business risks

- Financial information

- Financial highlights

- Quarterly order trends

- Consolidated financial statements

- Consolidated financial forecasts

- Stock & bond information

- Stock Information

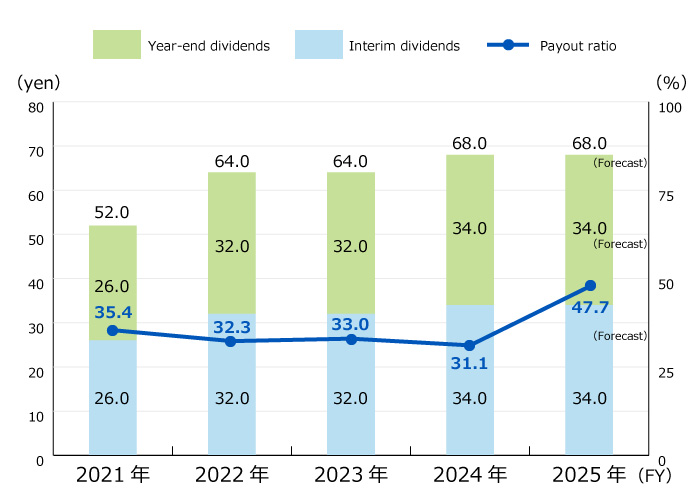

- Dividends & shareholder return

- General shareholders meetings

- Analyst coverage

- Rating & bond informationn

- At a glance

- IR News

- IR calendar

- Glossary

- FAQ

- Disclaimer

- SustainabilitySustainability

- Sustainability for the Yaskawa Group

- Message from the President

- Sustainability policy

- Sustainability management

- Value creation process

- Sustainability challenges and targets

- ESG data

- GRI Content Index

- Corporate governance

- Basic approach to corporate governance

- Internal control system

- Corporate governance structure

- Directors & executive officers

- Directors’ compensation

- Policy on cross-shareholdings

- Environment

- Environmental vision & targets

- Environmental management

- Disclosures based on TCFD

- ISO14001

- Green products

- Green process

- Biodiversity

- Energy-saving

- CO2 reduction by products

- Human resources

- Policy on human resources

- Human capital initiative

- Deepening the understanding of Yaskawa Principles

- Diversity & inclusion

- Training and optimal placement of human resources

- Realization of a comfortable working environment

- Improving engagement through dialogue

- Customer satisfaction

- Supply chain

- Social contribution

- Human rights

- Compliance & risk management

- Contact

Principles & vision

Principles & vision

Procurement

Procurement

Sustainability for the Yaskawa Group

Sustainability for the Yaskawa Group

Customer satisfaction

Customer satisfaction

Supply chain

Supply chain

Social contribution

Social contribution

Compliance & risk management

Compliance & risk management