1) Basic compensation

At the 99th Ordinary General Meeting of Shareholders held on June 18, 2015, a resolution was passed to set a fixed limit of 430 million yen or less for the basic remuneration of Directors. Details are as follows. The number of Directors subject to this basic remuneration is 12 or less, as stipulated in the Articles of Incorporation.

・Directors (excluding outside directors)

As directors assume the responsibility of improving corporate value, a certain amount will be paid according to the performance evaluation and position of each Director.

・Outside Directors

Outside directors are responsible for supervising the execution of duties, so a fixed amount is paid in advance.

2) Performance-linked compensation

At the 99th Annual General Meeting of Shareholders held on June 18, 2015, the Company resolved as follows. The number of Directors who are eligible for this performance-linked compensation is limited to 12 or less in accordance with Yaskawa’s Articles of Incorporation.

・Directors (excluding outside directors)

The maximum amount of performance-linked compensation shall be 1.0% or less of the consolidated net income of the fiscal year prior to the general meeting of shareholders elected or reappointed, in order to further clarify the link with consolidated performance. The amount of remuneration for each Director is calculated by taking into account the relative results to Yaskawa’s business performance from the standard deviation based on operating profit rate, operating profit growth rate and ROA of other companies in the same industry.

・Outside Directors

Performance-linked compensation is not provided.

3) Stock compensation (medium- to long-term compensation)

・Directors (excluding Outside Directors)

The evaluation indices used to calculate stock-based compensation in mid-term business plan “Realize 25” from FY2023 to FY2025 are as follows. The stock compensation is calculated by the performance factor according to the target value of each evaluation index.

・Outside Directors

Points will be awarded according to whether or not the company‘s performance targets set under mid-term business plan “Realize 25” has been achieved.

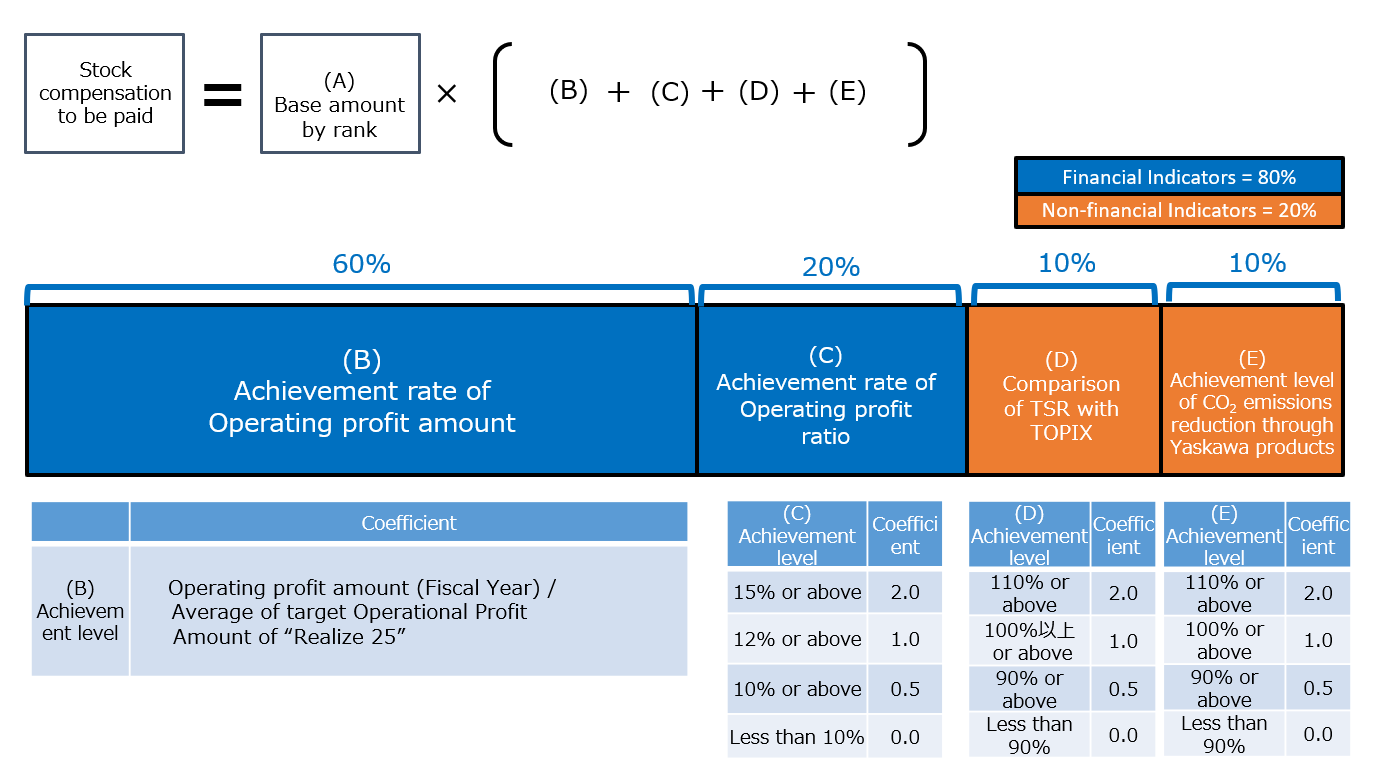

Evaluation Indicators and Formulas for Stock Compensation for Directors (Excluding Outside Directors)

(A)Base amount by rank

Considering the size and responsibilities of the areas in which Directors are responsible and their contribution to Group management, the Company sets the base amount according to their positions.

(B)Operational profit amount(fiscal year concerned)

Evaluations are based on operating profit amount for each fiscal year of the mid-term business plan “Realize 25” from FY2023 to FY2025.

(C)Operating profit ratio(fiscal year concerned)

The evaluation is based on the degree of achievement of operating profit ratio for the purpose of securing high competitiveness and growing into a highly profitable company.

(D)Comparison of TSR (total shareholders return) with TOPIX (fiscal year concerned)

Evaluations are conducted according to the degree of achievement of TSR with the aim of motivating directors to increase corporate value from the shareholdersʼ point of view.

(E)Achievement level of CO2 emissions reduction through Yaskawa products (fiscal year concerned)

In order to realize sustainable corporate activities and respond to social issues, Yaskawa evaluates the achievement of CO2 emission reduction targets through its products.

Policy on the proportion of each remuneration

・Directors (excluding outside directors)

Performance-linked compensation (single-year compensation) and stock compensation (medium- to long-term compensation) are designed so that any improvement in performance is returned as compensation without any upper limit. For this reason, if the performance of the indicators used as the basis for calculation is good, the ratio of basic compensation is relatively small. On the other hand, if the performance of the indicators used as the basis for calculation is poor, the ratio of basic compensation is relatively large.

・Outside Directors

From the perspective of independence, performance-linked compensation will not be paid, and base compensation as well as non-performance-linked stock compensation only when performance targets are achieved will be paid. The proportion of outside directors’ remuneration shall be as follows.

- (a)

- In the event that stock compensation does not accrue

Basic compensation: Stock-based compensation =

100%: 0%

- (b)

- When stock compensation is generated (when stock compensation is maximum)

Basic compensation:

Stock-based compensation = 75%: 25%

Remuneration of Audit and Supervisory Committee members

1) Basic compensation

The maximum amount of basic remuneration for Directors who are the members of the Audit and Supervisory Committee was fixed at a maximum of 150 million yen per year and resolved at the 104 th Ordinary General Meeting of Shareholders held on May 27, 2020. The number of Audit and Supervisory Committee Members subject to this basic remuneration shall be six or less pursuant to the provisions of the Articles of Incorporation of Yaskawa.

2) Stock compensation

Points will be awarded according to whether or not the company‘s performance targets set under mid-term business plan “Realize 25” has been achieved.

Methods of Determining Directors’ Compensation

The maximum amount of total remuneration for Directors (excluding directors who are Audit and Supervisory Committee Members. Hereinafter referred to as “Directors”.) and Directors who are Audit and Supervisory Committee Members (hereinafter referred to as “Audit and Supervisory Committee Members”.) is determined by resolution of the General Meeting of Shareholders. The remuneration of each Director is determined by the Board of Directors after deliberation by the Compensation Advisory Committee on the amount of remuneration calculated in accordance with the Officers’ Compensation Regulations, etc. The remuneration of each Audit and Supervisory Committee Member is determined through consultation with the Audit and Supervisory Committee.

In addition, Yaskawa has established the Compensation Advisory Committee, of which the majority are independent outside directors, under the Board of Directors to ensure the appropriateness and transparency of compensation for directors and executive officers through fair deliberation.

With regard to the stock compensation system for Directors and Audit and Supervisory Committee Members, shares are scheduled to be paid to Eligible Directors upon retirement in accordance with the Officers’ Share Benefit Rules.

Total Amount of Compensation, etc. by Director Category, Total Amount of Compensation,

etc. by Type, and Number of Applicable Directors (FY2024)

Region

Region

Principles & vision

Principles & vision

Procurement

Procurement

Sustainability for the Yaskawa Group

Sustainability for the Yaskawa Group

Customer satisfaction

Customer satisfaction

Supply chain

Supply chain

Social contribution

Social contribution

Compliance & risk management

Compliance & risk management